Purchasing a home is a significant milestone for many Americans. But navigating the complexities of mortgage loans can be daunting. This is where house loan calculators come in – powerful tools that can simplify the process and empower you to make informed decisions.

Understanding the Basics

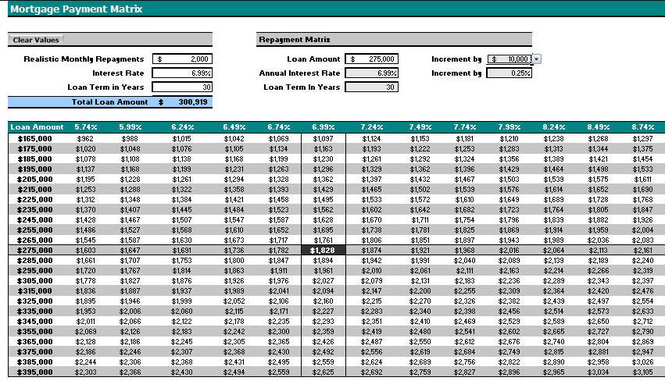

A house loan calculator estimates your monthly mortgage payment based on key factors like:

- Loan amount: The total sum you borrow from the lender.

- Down payment: The upfront amount you contribute towards the purchase price.

- Interest rate: The cost of borrowing the money, typically expressed as an Annual Percentage Rate (APR).

- Loan term: The duration of the loan, often 15 or 30 years in the USA.

Beyond the Basics

Many calculators offer advanced features to provide a more comprehensive picture:

- Property taxes and homeowners insurance: Estimate these ongoing expenses to factor into your monthly budget.

- Private mortgage insurance (PMI): This insurance is required if your down payment is less than 20% of the home’s value.

- Extra payments: See how additional monthly payments can accelerate paying off your loan and save on interest.

Benefits of Using a Calculator

- Affordability assessment: Gauge how much house you can comfortably afford based on your income and expenses.

- Scenario planning: Experiment with different loan terms, interest rates, and down payments to find the most suitable option.

- Comparison shopping: Use the calculator’s estimates to compare rates offered by different lenders https://homechief.us/.

Finding the Right Calculator

Numerous house loan calculators are available online from banks, mortgage lenders, and personal finance websites. Look for one that offers the features you need and a user-friendly interface.

Remember:

- Calculator estimates are for informational purposes only.

- Always consult a mortgage professional for personalized advice and accurate rates based on your specific financial situation.

By leveraging the power of house loan calculators, you can approach your homeownership journey with greater confidence and make informed decisions that pave the way for a secure financial future.