1. Introduction

In the United States, buying a house often involves securing a mortgage, and understanding the financial implications is crucial. A house loan calculator USA serves as a valuable tool for prospective homebuyers, helping them estimate their mortgage payments, affordability, and other essential details. This article provides an in-depth exploration of house loan calculators in the USA, their features, and how to use them effectively.

2. What is a House Loan Calculator?

A house loan calculator is an online tool designed to calculate various aspects of a mortgage, including monthly payments, total interest paid, and loan amortization schedules. It takes into account factors such as loan amount, interest rate, loan term, and down payment to provide accurate estimates.

3. How Does a House Loan Calculator Work?

https://bighomeimprovement.com/ use mathematical formulas to compute mortgage-related figures based on user input. Users typically enter details such as loan amount, interest rate, loan term, and down payment percentage. The calculator then processes this information to generate results that help users make informed decisions about their home purchase.

4. Key Features of House Loan Calculators

House loan calculators offer various features to assist users in understanding their mortgage options:

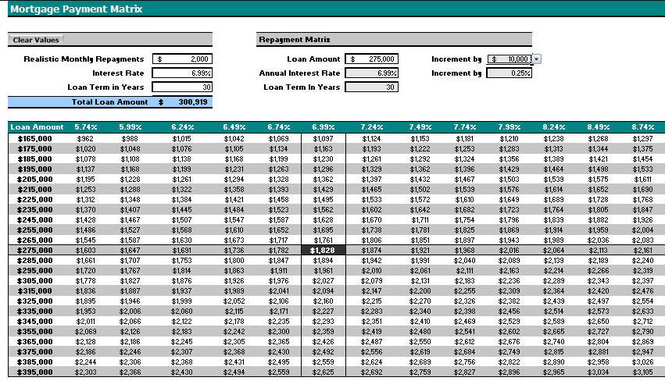

Mortgage Payment Calculation

Calculates the monthly mortgage payment based on the loan amount, interest rate, and loan term.

Amortization Schedule

Displays a detailed breakdown of each monthly payment, including the portion allocated to principal and interest.

Affordability Analysis

Helps users determine the maximum loan amount they can afford based on their income, expenses, and other financial factors.

Comparison Tool

Allows users to compare different loan scenarios by adjusting variables such as interest rate, loan term, and down payment.

5. Benefits of Using a House Loan Calculator

Utilizing a house loan calculator offers several advantages to prospective homebuyers:

Financial Planning

Enables users to plan their budget more effectively by estimating monthly mortgage payments and total loan costs.

Decision Making

Empowers users to make informed decisions about their home purchase by exploring various loan scenarios and understanding their financial implications.

Time Saving

Saves time by providing quick and accurate calculations, eliminating the need for manual computations or consultations with lenders.

6. How to Use a House Loan Calculator Effectively

To make the most of a house loan calculator, users should follow these tips:

Gather Necessary Information

Collect relevant details such as loan amount, interest rate, loan term, and down payment percentage before using the calculator.

Experiment with Different Scenarios

Explore various loan scenarios by adjusting parameters like interest rate, loan term, and down payment to understand their impact on monthly payments and total costs.

Consider Additional Costs

Factor in other expenses such as property taxes, homeowner’s insurance, and private mortgage insurance (PMI) to get a comprehensive view of homeownership costs.

7. Conclusion

A house loan calculator USA is an invaluable tool for anyone considering buying a home in the United States. By providing accurate estimates of mortgage payments and other financial details, these calculators empower users to make informed decisions about their housing finance. Understanding how to use a house loan calculator effectively can streamline the homebuying process and contribute to a successful homeownership journey.